撰稿人 | 桑之未

汽车流通行业分析师/中国汽车流通协会专家委员会成员

(This article is attached with English translation)

【本文关键词】豪华车市场/经销商销量/市场份额/平均售价/折扣率

这是关于2020年豪华车市场的第3篇报告,【本文关键词】豪华车/经销商销量/市场份额/平均成交价/折扣率;更多报告可通过公众号底部菜单「月度报告」获取,感谢您的关注!

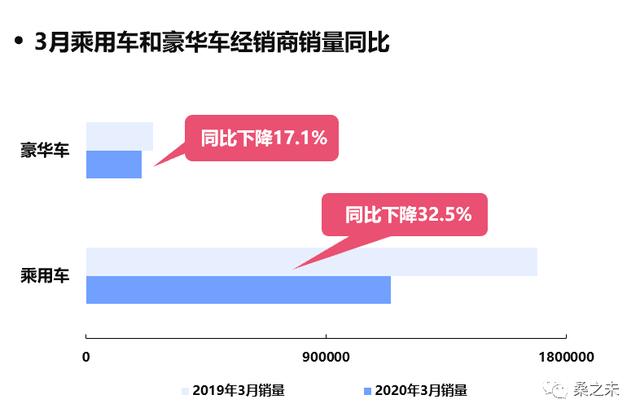

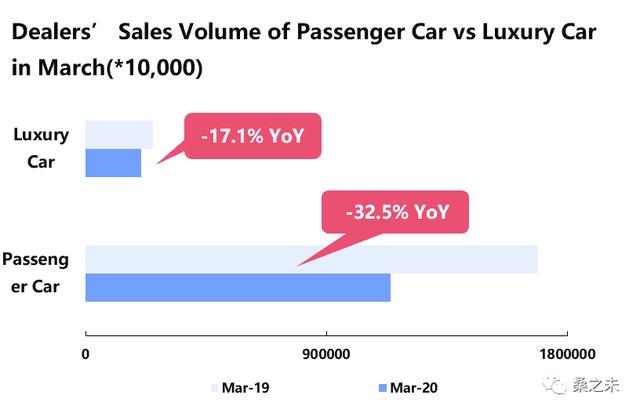

2020年第一季度,国内乘用车经销商零售319万辆,同比下滑42%,与去年同期比经销商零售减少227万辆;其中20个品牌豪华车企经销商零售为51.8万辆,同比下滑26%,比去年同期减少18万辆。3月份国内乘用车经销商零售114万辆,同比下滑33%,环比回升45个百分点;20个品牌豪华车企经销商零售为20.9万辆,同比下滑17%,环比回升54个百分点。一季度销量数据显示,豪华车成为汽车整体销量最为抗跌的板块,一线城市和东部、南部区域成为豪华车销量增长主力区域。

据流通协会数据显示,截止3月末,全国经销商门店复工率达95.5%,客流恢复率达64.0%,销售效率达61.7%,相比2月末复工率提升65.5个百分点,销售效率提升39.7个百分点;国内汽车零售端总体恢复情况比较理想,这有助于4月的销量进一步提升。

社会消费品零售总额汽车类下滑30.3%

一季度,疫情对国内整体经济影响较大,据国家统计局数据显示一季度国内生产总值206,504亿元,按可比价格计算,同比下降6.8%。一季度,全国居民人均可支配收入8561元,同比名义增长0.8%,扣除价格因素实际下降3.9%;同期全国居民消费价格同比上涨4.9%。一季度,社会消费品零售总额78,580亿元,同比名义下降19.0%;3月社会消费品零售总额26,450亿元,同比下降15.8%(扣除价格因素实际下降18.1%);一季度,社会消费品零售总额汽车类同比下滑30.3%至6326亿;3月社会零售总额汽车类同比下滑18.1%至2609亿。一季度豪华车零售总额为2038亿,同比下滑30%,其中3月零售总额为785亿,同比下滑18%。国内的生产与消费两端的下滑,对汽车流通行业影响较大,消费者收入降低将会直接影响其对大宗消费品的消费信心,如果国家刺激政策适度,随着经济逐步恢复,汽车消费也有机会逐步回升。

新车零售市场急需普惠式刺激政策

3月国家各部委联合推出有关刺激汽车消费的政策,包括新能源汽车购置补贴和免征购置税政策延长2年、全面取消二手车限迁政策、二手车经销企业销售旧车减按销售额0.5%征收增值税、淘汰国三车“以旧换新”、上海、广州、杭州等限牌城市增加牌号资源、‘国六’排放标准延后实施、皮卡进城限行解禁、以及各地方推出购车补贴等。

今年地方也出台了相关汽车消费刺激政策,这是此前少有的,从各地方提供的补贴金额来看,相当于购置税减半的力度,但是从山西、广西、长沙、湘潭、长春、宁波等出台的政策看,只是鼓励当地消费者购买地产车,消费者只有购买地产车,在当地上牌才可以享受补贴,这种做法涉嫌触及反垄断法,其本质是一种歧视行为,滥用行政权力限制竞争,在市场条件下对有着平等地位的市场主体实施了不平等的待遇;对同样为当地缴税、同样解决当地就业的其他品牌经销商并不公平,有失政府的信誉与公正。

综合目前出台的刺激政策只是部分刺激车市,并没有对整体新车销售市场起到积极的促进作用;新车市场急需像前两次刺激车市时使用的购置税减半、降低增值税等普惠式刺激政策,这些政策能够惠及全国消费者;对经销商来说,普惠式的刺激政策实际替代了厂家的广告,能够把消费者带到店里,增加店内客流量从而带动销量提升。如果不能在近期出台普惠式刺激车市的政策,汽车消费在第二季度只能缓慢回升,而第二季度末,车企将会调整下半年销售计划,假设第三、第四季如果能维持去年销售规模,全年经销商零售销量预计下跌15%左右,比去年减少大约300万辆左右,销量将会跌至2000万辆以内,新车零售总额损失5000亿左右。

国外疫情对国内进口车全年零售影响不大

3月,欧美日本等国家受到疫情影响,奔驰、宝马、奥迪、保时捷、雷克萨斯、沃尔沃、林肯、兰博基尼、法拉利等车企把工厂关闭时间延长至4月或5月,这对进口车销售产生一定的影响,由于各家进口车企对中国的出口到货时间差不多是N+3个月份(丰田约为1个月),对进口车销量的影响会在后几个月显现;另外2月国内经销商因为疫情暂停销售,积累的进口库存在3月份释放,所以国内进口车库存较为充足,对销售实际影响不大;4月份随奔驰等品牌开始逐步开启欧洲工厂生产,进口车资源全年看还是较为充裕的,各家车企预计不会调整进口车全年销售目标 。

豪华车成为最抗跌板块,市占率进一步攀升

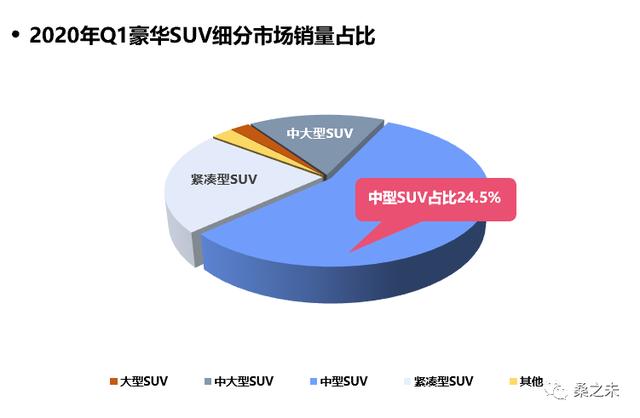

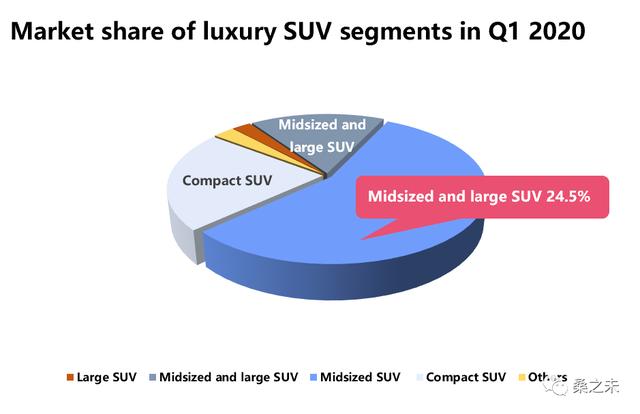

一季度,豪华车市占率为16.2%,同比上升3.4个百分点,3月豪华车市占率为18.3%,同比上升3.5个百分点,市占率创近几年新高。一季度奔驰、宝马、奥迪、雷克萨斯、凯迪拉克、沃尔沃市占率居前;从细分市场角度分析,一季度,豪华轿车市占率为54.5%,同比下降1.6个百分点,豪华SUV市占率上升1.6个百分点,其中中型SUV市占率为24.5%,同比增长2.8个百分点,带动了SUV细分市场增长;一季度中型轿车市场占有率下滑1.5个百分点至24.2%,作为豪华车市场两个销量最大的细分市场,用户重叠度高,主要受新产品和新车价格的影响较大,销量此消彼长。

车企加大对经销商支持力度

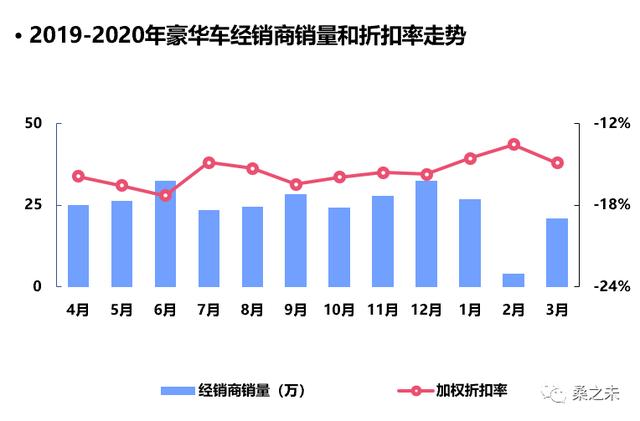

豪华车折扣率保持平稳

3月,豪华车市场整体加权成交均价在39万元左右,与1月份比较价格下滑1.8万元,与进口车销量减少有关;折扣率维持在14.9%上下,与1月份比较下滑0.3个点,市场价格比较平稳;车企加大对经销商的返利支持力度,与1月份比较返利增加0.7个点;3月豪华车企延续2月份政策,继续为经销商提供流动性支持,加快下发返利奖金,延长库存融资免息期;取消或者降低新车销售考核目标等。作为疫情结束的首个完整销售月份,市场的各项指标走势良好,这对后续几个月市场销量回升打下一个良好的基础。

区域中心城市豪华车市场恢复较快

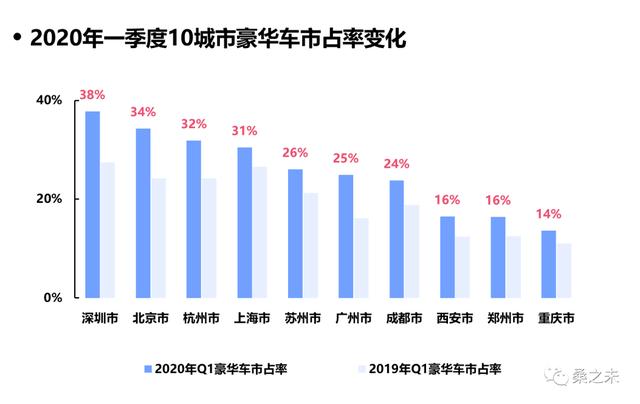

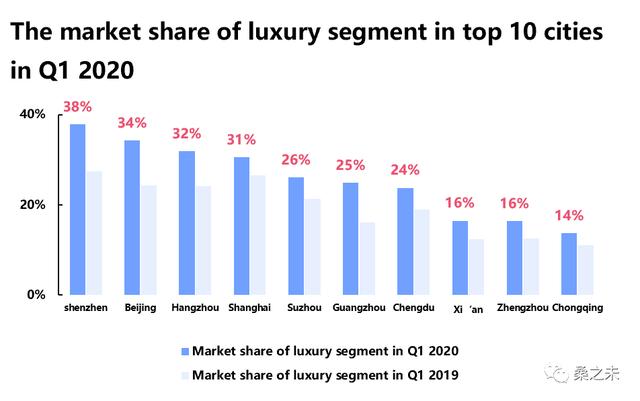

一季度,10城市乘用车销量为72万辆,同比下滑45%,其中豪华车销量为18万辆,同比下滑28%,10城市豪华车市占率由去年同期的20%上升至26%;10城市中,北京、深圳豪华车销量市占率同比上升10个百分点,广州上升9个百分点,杭州上升8个百分点,苏州与成都上升6个百分点。从10城市销量数据显示,区域中心城市的豪华车零售市场恢复得较快,这些城市的消费者有比较强的资金实力,对未来有较好的预期,随着疫情结束,区域中心城市汽车消费开始恢复活力;3月,杭州、苏州、重庆、上海、西安等城市豪华车市场恢复较快,豪华车销量同比下滑在13%以内;3月仅北京市场下滑46%,主要受疫情影响,跟新车检测场没有开放,新车、二手车不能正常交易有关。(笔者选取国内十个区域中心城市对零售市场进行观察,涵盖东区、西部,一线二线、三线市场;10城市:北京、上海、广州、深圳、成都、重庆、郑州、苏州、杭州、西安)

奔 驰

一季度,奔驰经销商零售量为14万辆,同比下滑23%,市占率为27.1%。一季度,奔驰官方公布的销量为13.9万辆,同比下滑20%,奔驰销量下滑低于行业均值,这与去年年末积累的订单今年前两个月集中交付有关。据北京统计局公布的数据显示,一季度北京汽车制造业增值下降30.2%,全市生产汽车29.5万辆,比上年同期下降27.9%。北京奔驰从2月10日开始复工,作为北京汽车工业中最优质的资产,北京奔驰承担产量与产值的双重压力;一季度乘联会数据显示北京奔驰销量为11万辆,占北汽集团销量的56%,这对奔驰的零售与价格产生较大的压力 。

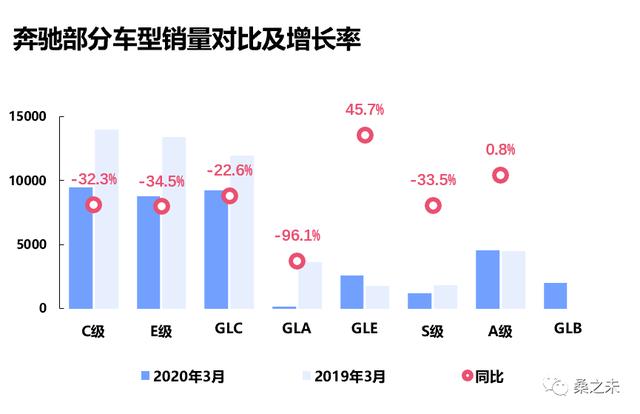

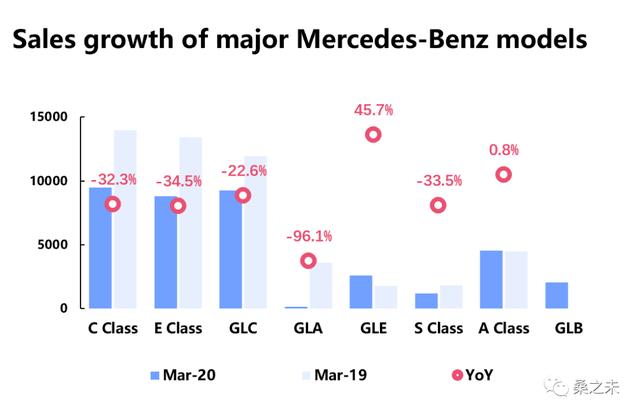

3月,奔驰新车成交均价为48万元,与去年同期比较上涨1.1万元,品牌折扣在10%左右,经销商新车销售有一定的利润空间。一季度,奔驰A级、GLB、GLC L三款车型销量增速较快,分担了奔驰C级、E级的销量压力,但这三款车型折扣率也有所增加。其中奔驰A级销量同比增长31%,达到1.3万辆,新车均价21.3万左右,与国产同级别车型比较,价格最贵,但与去年同期3月份比较,价格下降近2.2万元,这与销量的提升以及车型销售比例有关。新上市的GLB零售突破5000台,均价在33万元左右,同级别宝马X1均价在25万元上下,GLB销量和价格均有一定的拓展空间。GLC L零售超过3.1万辆,折扣与销售均价保持稳定。奔驰进口车销售主力GLE零售超过7500台,达到去年同期水平,销售均价保持在79万左右,属于经销商利润车型。

3月份奔驰零售销量在ABB中并不高,一季度受到疫情影响,各家车企并不追求销售量,3月份部分订单可以转到4月份,为第二季度的销量提升留下空间。北京奔驰生产抢进度,并没有调整生产计划,传递到销售层面,销售压力会在第二季度呈现,4月份的品牌折扣走势也证明了这一点。如果奔驰全年的销售目标没有调整,第一、第二季度销售进度又快于其他豪华品牌的话,那么下半年的销售压力会比其他品牌小一些。

宝马(MINI)

一季度,宝马品牌经销商零售量为11.7万辆,同比下滑29%,市占率为22.5%。MINI品牌经销商零售量为4900辆,同比下滑37%。一季度,宝马(MINI)官方公布的销量为12.2万辆,同比下滑29%。

3月,宝马新车成交均价为40万元,与去年同期比较上涨4.4万元,品牌折扣在14%左右。宝马新车成交均价上涨,主要与过去一年不断推出的新产品有关,新3系改款上市后,折扣回升较大,进口车包括新X5、新X7、新7系等均实现了改款或者换代,这些新车零售价格比老款有较大的提升,这对宝马品牌成交均价回升有较大的帮助。

华晨宝马工厂停工期间损失近2.5万台左右的产量,对此华晨宝马3月调整了生产计划,有助于缓解国产宝马的销售压力;乘联会数据显示,3月北京奔驰销量达到5.1万辆,比华晨宝马多出1万辆,3月经销商零售显示,奔驰比宝马少卖了7200台,这部分销量差会在第二季度显现,具体表现为奔驰经销商的库存压力会大于宝马经销商库存压力。

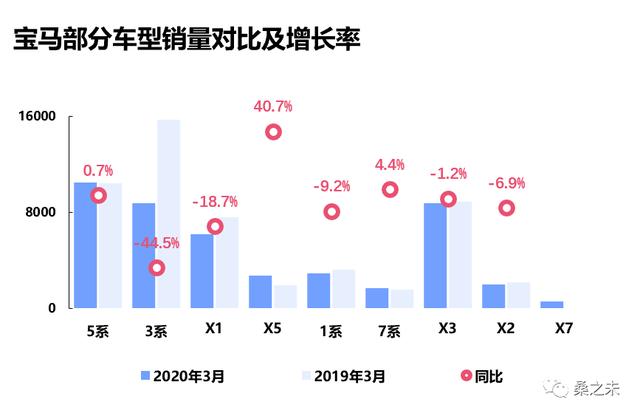

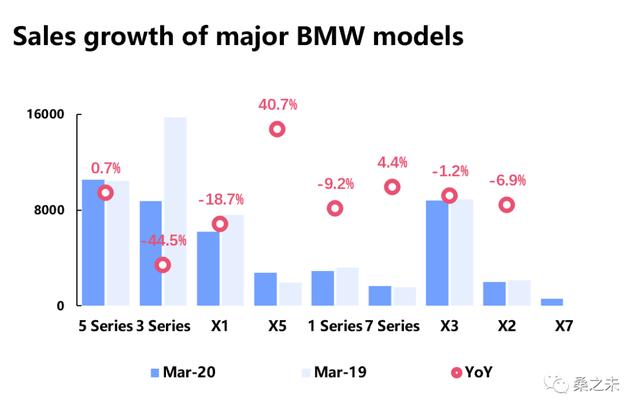

一季度,宝马5系销量达到2.7万辆,同比下滑14%,3月份宝马5系销量已经转正,超过1万辆,折扣在12%上下;宝马5系今年将迎来中期改款,产品力会得到进一步加强。一季度,宝马X3销量同比下滑16%,销量超过2万辆,3月销量也接近转正,折扣与宝马5系相同;宝马3系在去年末全新换代,今年月度销量将会维持在万辆左右,目前宝马3系的平均价格超过30万,与去年同期比较提升4万多,折扣维持在13%上下,与改款前比较也有很大的提升。宝马两款进口车X5、7系销量与价格也维持在较好的水平。一季度宝马的销售质量与去年同期比较有很大的改善。

奥 迪

一季度,奥迪经销商零售量为11.3万辆,同比下滑25%,市占率为21.8%,奥迪官方公布的销量与经销商零售量一致。

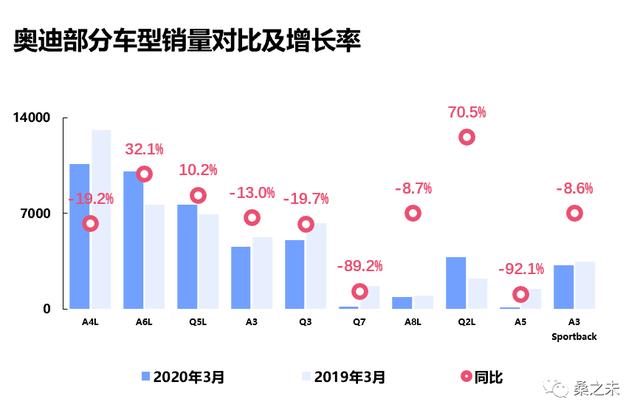

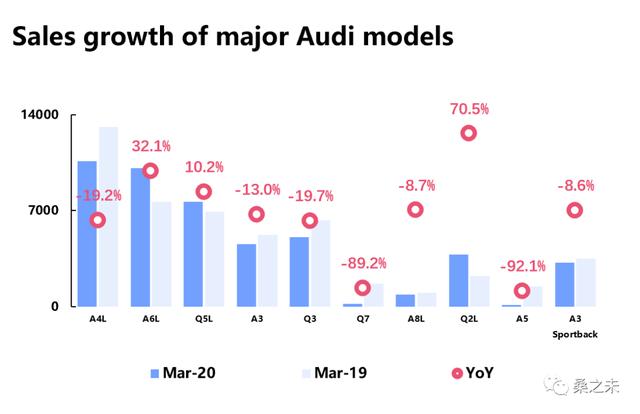

3月,奥迪新车成交均价为29万元,比去年同期下降2万元左右,品牌折扣率为24%,走势平稳。与奔驰、宝马比较,奥迪进口车销量较少,奥迪Q7等主力销售车型受疫情影响暂未上市,国产车型中,Q3、A3、Q2L等小车占比要比奔驰、宝马高,对成交均价有一定的影响。在单一车型成交均价方面,奥迪A6L上市5个季度,成交均价维持在36万左右,比上代A6L退市的价格有4万元的提升;同级别奔驰E级平均售价46万,宝马5系平均售价43万,虽然三款车型销量比较接近,但均拉开了价位区间;在中型SUV细分市场,奥迪Q5L均价维持在34万元左右,奔驰GLC L平均售价44万元,宝马X3平均售价37万元,三款车型也是销量接近,价位不同。

一季度,一汽奥迪受到疫情影响损失近4万台的产量,所以经销商销售压力不大,3月,奥迪优先向经销商提供A6L、Q5等畅销车型资源,帮助经销商恢复销售。一季度奥迪三款主销车型奥迪A4L、A6L、Q5L销量均超过2万辆,Q3、A3销量过万;进口车方面,受疫情等因素影响,销量下跌幅度较大,预计在第二季度将会有所改善。

凯迪拉克

一季度,凯迪拉克经销商零售量为2.6万辆,同比下滑40%,市占率为5.1%,比去年同期下滑1个点;一季度,凯迪拉克官方公布的销量为2.68万辆,同比下滑40%。

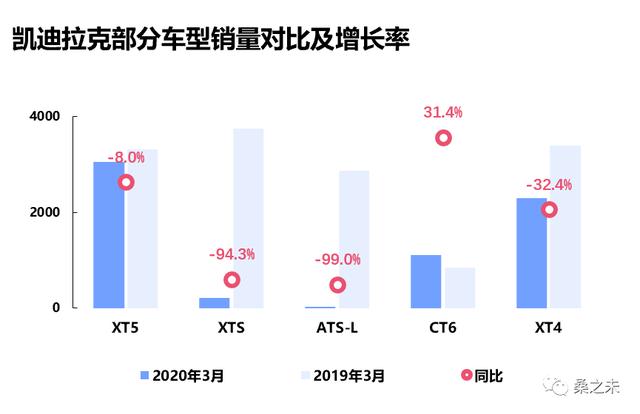

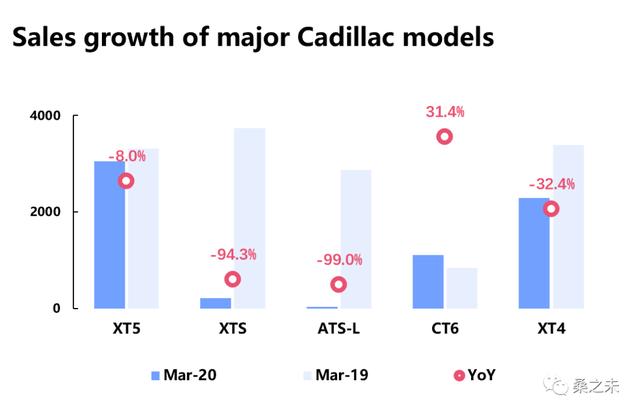

3月,凯迪拉克新车成交均价为30万元,比去年同期上涨2万元;品牌折扣率为18%,与去年同期比较减少2个点。凯迪拉克一年中实现了成交均价,折扣率双回升,这体现了管理团队的工作绩效,这一业绩的取得主要是依靠发布售价更贵的新车并对发布新车改名得以实现的;与去年比较,老款零售折扣30个点左右的ATS-L、XTS退市停售,改款发布了CT5、CT4两款新车型,并在去年7月推出全新中大型SUV车型CT6,售价41.97万起,这对品牌折扣率与成交均价回升均有很大的帮助。不过在售车型折扣与成交均价走势并不好,如主力销售车型XT5与去年同期比较,成交均价从34.2万元下滑至30.6万元,减少3.6万元,不过折扣率走势向相反,从去年同期的25%却减少到20%,收了5个点的折扣,折扣的回升,主要是通过调整新车指导价实现的;2017年11月,凯迪拉克发布XT5 28E四驱技术型售价37.99万元,2019年6月XT5中期改款,同款车型售价为34.97万,指导价下调3万多,这对XT5的折扣率回升帮助很大。凯迪拉克在售的两款车型,由于没有到中期改款,厂家指导价也没有调整,折扣与均价更能反应真实状态,CT6成交均价为33万元,与去年同期比较下滑4.3万元,折扣率为25%,与去年同期比较增加6个点;XT4成交均价为25万元,与去年同期比较下滑3.2万元,折扣率为20%,与去年同期比较增加9个点;从以上数据不难看出,凯迪拉克逐渐放弃高定价、高折扣的销售思路,开始降低新车指导价,降低新车销售折扣,减少高折扣对品牌的伤害,逐步提升品牌价值。

雷克萨斯

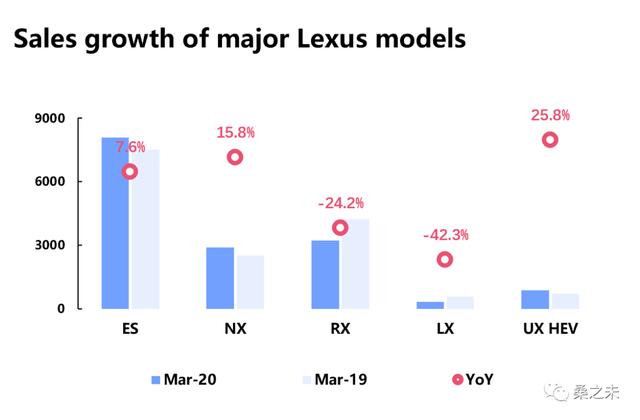

一季度,雷克萨斯经销商零售量为3.2万辆,同比下滑18%,市占率为6.3%;官方公布的销量为2.8万辆,同比下滑25%。

3月,雷克萨斯新车成交均价为41万元,比去年同期下滑5万元,这与雷克萨斯LX、GS等售价较贵的车型销售减少有关。

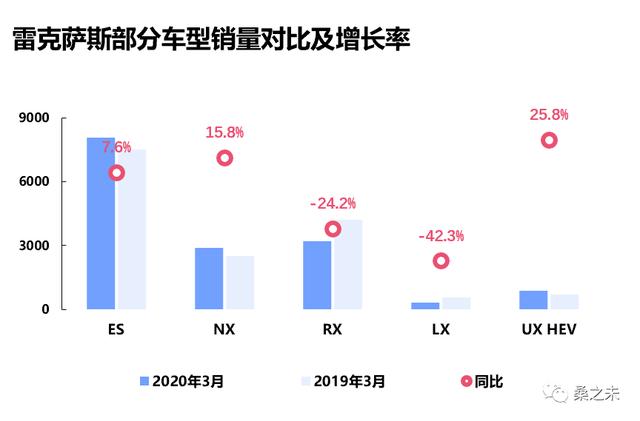

一季度,从经销商零售角度观察,雷克萨斯销量下滑较少,这与雷克萨斯一直保持订单销售有关,一季度交付的车辆,多数是去年以及1月份的订单,只要新车资源供应能够保证,经销商零售不会有很大压力。1季度ES销量近1.6万辆同比下滑3.2%,NX销量6200台同比下滑4.1%,RX受供应影响销量下滑35%为6700台,但成交均价上涨5000元。

捷豹路虎

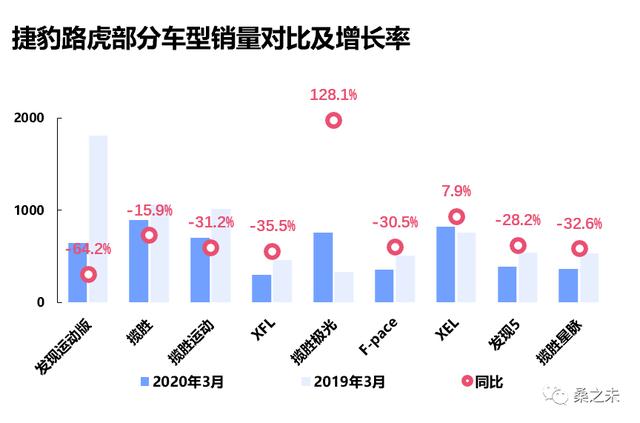

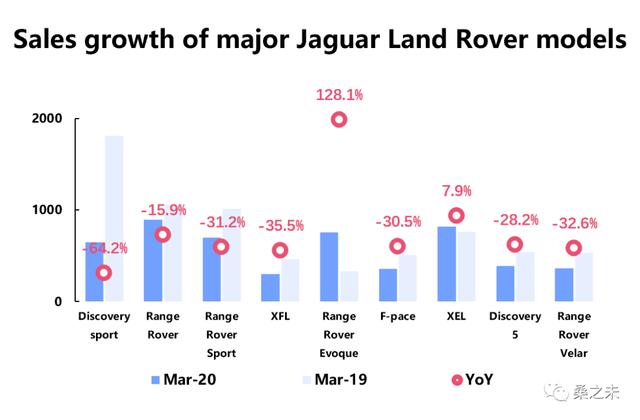

一季度,捷豹路虎国产车型零售销量下跌较多,同比下滑46%,国产发现运动改款上市赶上疫情,生产与批售都受到影响,预计第二季度销量能得到比较好的提升。

3月,捷豹路虎单月展厅客流与订单情况得到显著提升。针对经销商推出的11项举措,包括为展厅员工提供防疫物资、取消单月考核、给予库存补贴、启动全面线上营销培训等多个领域,有效缓解了经销商合作伙伴在疫情防控及商务运营方面的压力。目前,捷豹路虎在华经销商已基本全网恢复运营。

沃尔沃

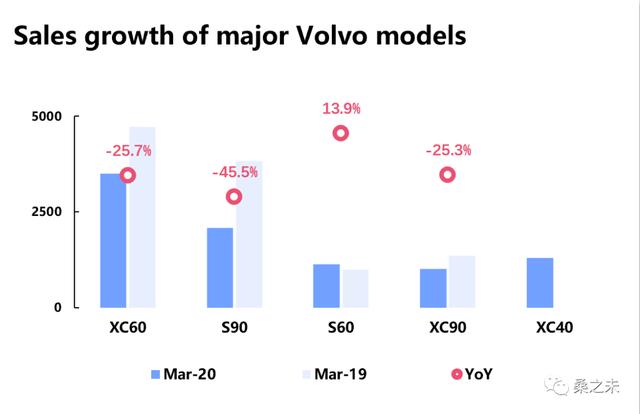

一季度,沃尔沃经销商零售量2.3万辆,同比下滑28%,官方公布的销量为2万辆同比下滑31%。一季度沃尔沃市占率为4.4%,品牌均价为33万元。

保时捷

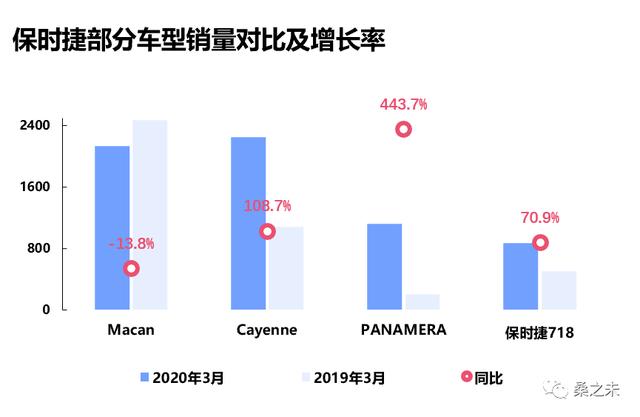

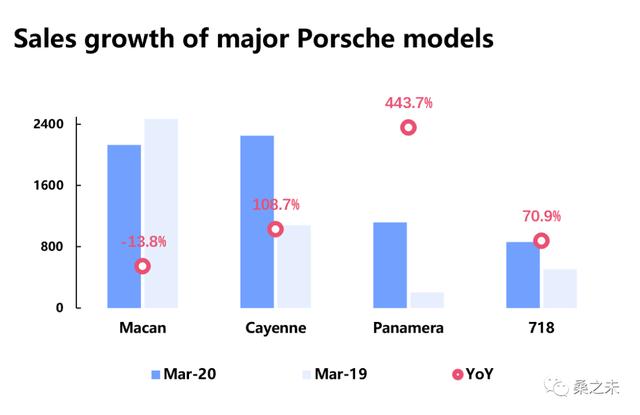

一季度,保时捷经销商零售量1.5万辆,同比下滑10%。其中3月销量6600台,同比增长51%,销量开始出现回暖。一季度,保时捷采取加快返利、金融支持等多项措施,帮助经销商改善现金流和增加资金流动性。在新车交付方面,提供更加畅销的车型给到经销商,使得消费者可以很快从经销商处提到预订的车,帮助经销商恢复新车销售业务。另外,保时捷中国根据市场具体的恢复状况,就经销商关心的备件采购目标调整、新车批售、下发返利等影响经销商健康运营的核心指标,与经销商保持沟通和协商。

林 肯

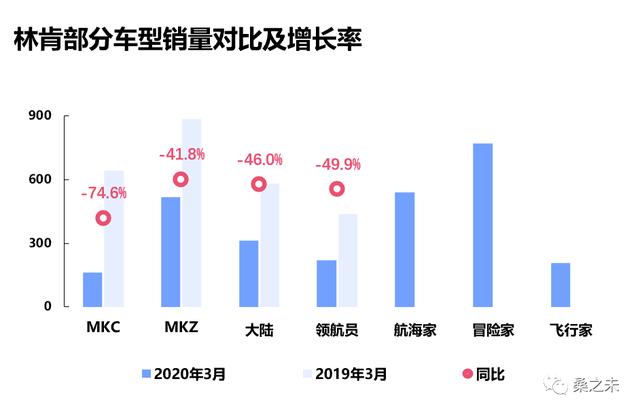

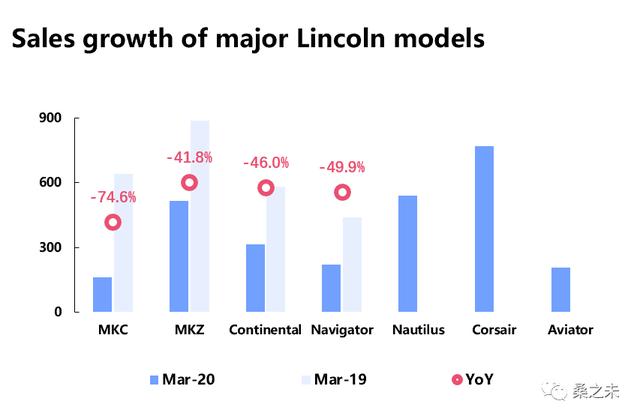

一季度,林肯经销商零售量6300辆,同比下滑28%;其中3月,销量为2735辆,同比下滑30%。一季度,林肯市占率为1.2%,品牌均价为40万元。二季度国产车型冒险家将进入完整季度销售,有助于提升林肯品牌销量。

英菲尼迪

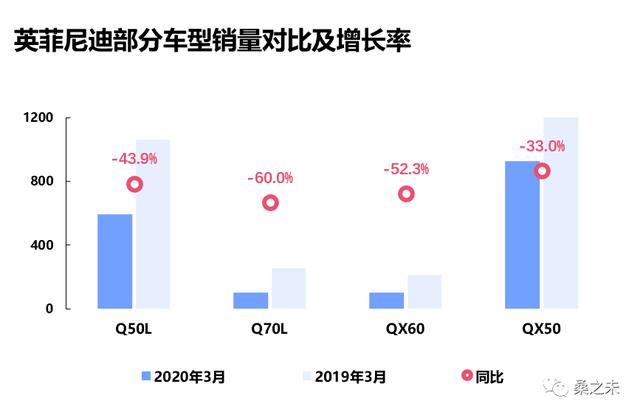

一季度,英菲尼迪经销商零售量4400辆同比下滑55%;其中3月,销量为1800辆,同比下滑51%。一季度,英菲尼迪市占率为1.2%,品牌均价为30万元。

玛莎拉蒂

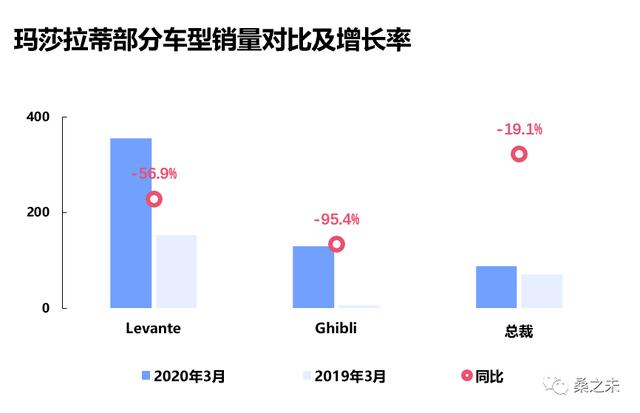

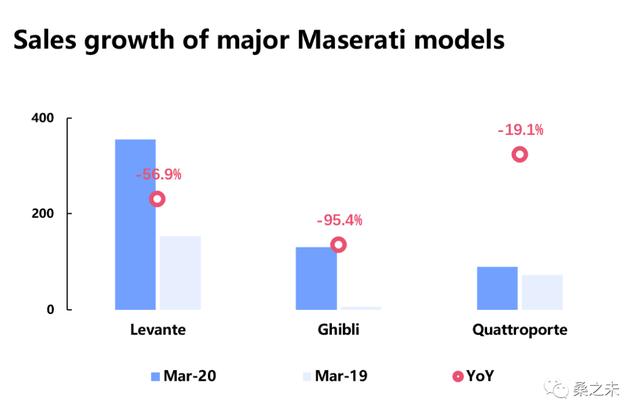

一季度,玛莎拉蒂经销商零售量590辆,同比下滑68%,其中3月,销量为230辆,同比下滑35%。

讴 歌

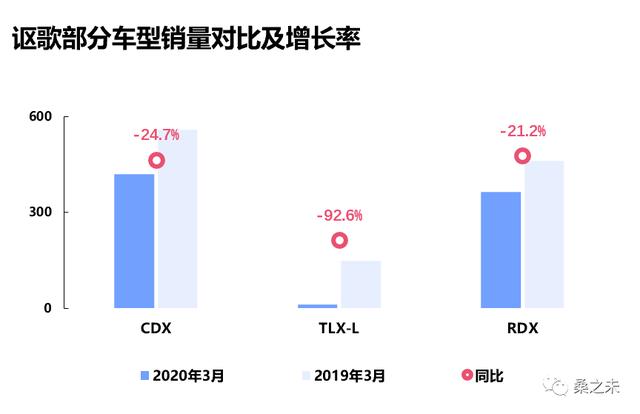

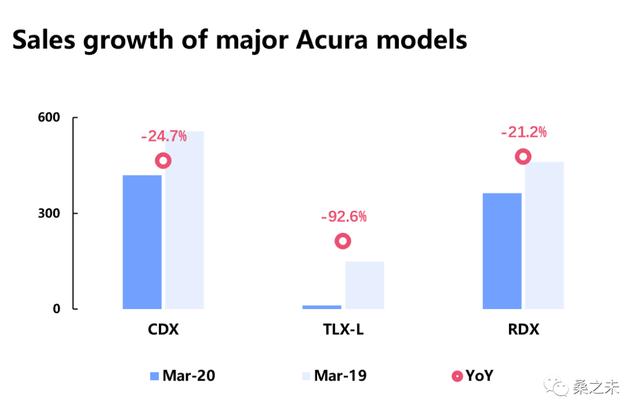

一季度,讴歌经销商零售量1844辆,同比下滑36%;其中3月,销量为795辆,同比下滑18%。

特斯拉

3月特斯拉零售1.3万辆,其中国产model 3占88%;其中销量前十城市占整体销量的98%,特斯拉销量集中在中大型城市;上海销量超过3000台;北京、杭州、广州、深圳销量均超过1000台,北京销量近1800台;不限购城市成都、苏州销量超过500台;南京、宁波、重庆、天津、西安、青岛、厦门销量突破300台。3月是特斯拉重点的季度末交付月份,此前从2019年6月1日开启的国产车预定收单,批量在3月集中交付;目前预定model 3可以在2-4周内交付,4月特斯拉启动金融促销政策,说明订单获取是目前重中之重的任务。

更多链接:

劳斯莱斯经销商零售销量为189辆,同比下滑18%;

宾利经销商零售销量为600辆,同比增长4%;

法拉利经销商零售销量为13辆,同比下滑93%;

兰博基尼经销商零售销量为25辆,同比下滑90%;

阿斯顿马丁经销商零售销量为56辆,同比下滑57%;

版权声明:本文系@桑之未 #原创首发# 转载或改编请与本人沟通,如有任何侵权行为,侵权者将承担相应的法律责任。2020-04-29

【往期精选内容】

★ 豪华车月度报告:

受到疫情影响豪华车零售下滑71%,各家车企出台政策支援经销商

受新年假期影响,1月份豪华车零售27.1万辆同比下滑14.8%

2019豪华车零售309万辆增长7.5%,2020增幅有望提升至10%

★ 高层领导专访:

对话严博禹:工厂暂时关闭不会影响中国业务,多措并举协助经销商恢复运营

对话钦培吉:逆势增长背后,打造创新用户体验

对话刘彤:零售终端信心回升,捷豹路虎产品年未来可期

★ 行业热点分析:

从“车盖女神”到“4S店车闹” 过度维权恐得不偿失

吉利收Smart意在奔驰,戴姆勒借势启动第二家合资公司

大众首提股比提升 奔驰、丰田跟进通用、福特暂无计划

Sang Zhiwei: In Q1, the dealer retail sales dropped by 2.27 million in which the luxury car market became the most resistant segment

Written by / Sang Zhiwei

Insight into the Chinese Luxury Car Market

Report | Data | Consulting

Keywords:Luxury car market, Sales volume of dealer, Market share,Average selling price,Discountrate

This is the 3rd luxury car market analysis report in 2020. The previous report can be obtained through the bottom menu "Monthly Report", thank you for your support!

In Q1 2020, dealer sold 3.19 million domestic passenger cars with a YoY decline of 42%, and a decrease of 2.27 million units from the same period last year. 20 luxury brands retailed 518,000 units with a YoY decline of 26%, and a decreased of 180,000 units from the same period last year. Among them, dealer retailed 1.14 million domestic passenger cars in March, down 33% YoY, up 45% MoM. Dealer retail sales of 20 brand luxury car were 209,000 units, down 17% YoY, and up 54% MoM. Luxury cars have become the most resistant segment of overall market. First-tier cities and the eastern and southern regions have become the main regions for luxury car sales growth.

According to the data from CADA, as of the end of March, the national dealer store resumption rate was 95.5%. The showroom traffic recovery rate was 64.0%. The sales efficiency was 61.7%. Compared with the end of February, the resumption rate increased by 65.5% and the sales efficiency increased by 39.7%. The overall recovery situation of domestic auto retail is relatively satisfactory, which helps to further increase sales in April.

Total retail sales of consumer goods for automobiles fell 30.3%

In Q1, the epidemic had a greater impact on the overall domestic economy. According to data from the National Bureau of Statistics, the gross domestic product for Q1 was 206.5504 trillion yuan, a YoY decrease of 6.8% at comparable prices. In Q1, the national per capita income of residents was 8,561 yuan, a nominal increase of 0.8% YoY, and a real decrease of 3.9% after deducting price factors. The national consumer price rose by 4.9% YoY. In Q1, total retail sales of consumer goods reached 7.858 trillion yuan, a nominal decrease of 19.0% YoY. In March, the total retail sales of social consumer goods was 2,645 billion yuan, down 15.8% YoY (reduced by 18.1% after deducting price factors). In Q1, the total retail sales of social consumer goods fell 30.3% YoY to 632.6 billion. The automotive category fell 18.1% YoY to 260.9 billion. The total retail sales of luxury segment in Q1 was 203.8 billion, a 30% YoY decline, of which the retail sales in March were 78.5 billion, a 18% YoY decline. The decline in domestic production and consumption at both ends has a greater impact on the automobile industry. The lowering of consumer income will directly affect their consumer confidence in bulk consumer goods. If the national stimulus policy is moderate, as the economy gradually recovers, automobile consumption may also have a chance to rebound gradually .

New car retail market urgently needs inclusive stimulus policies

In March, various national ministries and commissions jointly launched policies on stimulating automobile consumption, including 1) NEV purchase subsidies and purchase tax exemption policies extended for 2 years; 2) The comprehensive removal of second-hand car restriction policies, 3) Second-hand car dealers selling used cars reduced by sales 0.5% VAT; 4) phase-out of the replacement of the national III emission standard vehicles; 5) The increase of number plates in Shanghai, Guangzhou, Hangzhou and other limited-licensed cities; 6) The delay of the implementation of the national VI emission standard; 7) The lifting of the ban on pickup trucks into cities; 8) And the introduction of subsidies for car purchases .

This year, local governments have also introduced relevant auto consumption stimulus policies, which are rare before. Judging from the amount of subsidies provided by various localities, it is equivalent to reducing the purchase tax by half. But from Shanxi, Guangxi, Changsha, Xiangtan, Changchun, Ningbo when the policy is introduced, it only encourages local consumers to buy locally produced vehicles. This approach is suspected of touching anti-monopoly law. Consumers can only enjoy subsidies if they buy locally produced vehicles and license locally. This is essentially a discriminatory behavior and abuses administrative power restrictions. Competition has imposed unequal treatment on market players with equal status under market conditions. Other brand distributors who also pay local taxes and also solve local employment are unfair and lose the credibility and justice of the government.

In general, the current stimulus policy only partially stimulates the car market, and it has not played a positive role in promoting the overall new car sales market. The new car market urgently needs inclusive stimuli such as the reduction of the purchase tax in half and the VAT used in the previous two stimulus car markets policies. These policies can benefit consumers across the country. For dealers, the inclusive stimulus policy actually replaces the OEMs ’s advertising and can increase showroom traffic and drive sales. If the inclusive policy of stimulating the auto market cannot be introduced in the near future, auto consumption will only pick up slowly in Q2. At the end of Q2, auto companies will adjust their sales plans for H2, assuming that Q3&Q4 can maintained last year's sales scale, the annual dealer retail sales are expected to fall by about 15%, which is about 3 million fewer than last year. Sales will fall to less than 20 million, and the total retail loss of new cars will be about 500 billion yuan.

Foreign epidemics have little effect on the annual retail sales of imported cars

In March, countries such as EU, America, and Japan were affected by the epidemic. Mercedes-Benz, BMW, Audi, Porsche, Lexus, Volvo, Lincoln, Lamborghini, Ferrari and other OEMs delayed the factory reopen time to late April or May. This will have a certain impact on imported car sales. The time of arrival of imported cars to China is almost N + 3 months (Toyota is about 1 month). The impact on the sales of imported cars will appear in the next few months. In February, domestic dealers suspended sales due to the epidemic, and the accumulated import inventory began to be released in March. Therefore, imported car inventories are relatively sufficient, which has little effect on sales. In April, Mercedes-Benz and other brands began to gradually open European factory production and imported car resources. The year’s inventory is still relatively ample, and various auto companies are not expected to adjust the annual sales target of imported cars.

Luxury cars have become the most resistant segment with a further increased market share

In Q1, the market share of luxury cars was 16.2%, an increase of 3.4% YoY. Among them, the market share of luxury cars was 18.3% in March, an increase of 3.5% YoY. The market share reached a new high in recent years. In Q1, the market share of Mercedes-Benz, BMW, Audi, Lexus, Cadillac and Volvo ranked tire one. From the perspective of market segmentation, in Q1, the market share of luxury cars was 54.5%, a decrease of 1.6 % YoY. The market share of luxury SUVs increased by 1.6% YoY, of which the market share of mid-sized SUVs was 24.5%, an increase of 2.8% YoY. The market share of the mid-sized sedan fell 1.5% YoY to 24.2% this quarter. As the two largest segments in the luxury car market, customer overlap is high, mainly affected by new products and new car prices. Sales are changing accordingly.

OEMs increase support for dealers, luxury car discount rate remains stable

In March, the overall weighted average price of the luxury car market was around 390,000 yuan, which was 18,000 yuan lower than the price in January, which was related to the decrease in imported car sales. The discount rate remained at around 14.9%, down 0.3% compared with January. The market price is relatively stable. OMEs increase their rebate support for dealers compared with January, the rebate increased by 0.7%. In March, luxury OEMs continued the February policy, continue to provide dealers with liquidity support; accelerate the issuance rebate bonus; extend the interest-free period of inventory financing; cancel or reduce the evaluation target of new car sales, etc. As the first complete sales month after the epidemic ended, the market's various indicators are trending well, which lays a good foundation for the rebound of market sales in the following months.

Luxury car retail sales has limited drop in regional central cities

In Q1, passenger car sales in 10 cities were 720,000, down 45% YoY, of which luxury car sales were 180,000 units, down 28% YoY. The market share of luxury cars in 10 cities rose to 26% from 20% in the same period last year ; Among the 10 cities, the market share of luxury car sales in Beijing and Shenzhen increased by 10% YoY, 9% YoY in Guangzhou, 8% YoY in Hangzhou, and 6% YoY in Suzhou and Chengdu. From the sales data of 10 cities, the luxury car retail market in the regional central cities has recovered faster. Consumers in these cities have relatively strong financial strength and better expectations for the future; as the epidemic ends, car consumption in the regional central cities begins Rejuvenated. In March, the luxury car market in Hangzhou, Suzhou, Chongqing, Shanghai, Xi'an and other cities recovered faster, and luxury car sales fell within 13% YoY. In March, only Beijing market fell 46%, mainly affected by the epidemic, and new and used cars cannot be traded normally. (The author selects ten domestic central cities to observe the retail market, covering the eastern and western regions, first-tier, second-tier, and third-tier markets. 10 cities: Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Zhengzhou, Suzhou, Hangzhou, and Xi'an)

Mercedes

In Q1, Mercedes-Benz dealers had a retail volume of 140,000, a YoY decline of 23% and a market share of 27.1%. In Q1, Mercedes-Benz officially announced sales of 139,000, down 20% YoY. Mercedes-Benz sales fell below the industry average. This is related to the orders accumulated at the end of last year and the concentrated delivery in the first two months of this year. According to data released by the Beijing Statistics Bureau, the value added of the Beijing automobile manufacturing industry fell by 30.2% in Q1. The city produced 295,000 vehicles, a decrease of 27.9% from the same period last year. Beijing Benz started to resume work on February 10th. As the most high-quality asset in the Beijing automobile industry, Beijing Benz is under double pressure of production and output value. The data of Q1 of CPCA shows that Beijing Benz sold 110,000 units, accounting for 56% of the total sales of BAIC Group. This puts greater pressure on Mercedes-Benz's retail and price.

In March, the average transaction price of Mercedes-Benz new cars was 480,000 yuan, an increase of 11,000 yuan compared with the same period of last year. The brand discount was about 10%. Dealers had a certain profit margin for new car sales. In Q1, Mercedes-Benz A-Class, GLB, and GLC L sales grew faster, sharing the sales pressure of Mercedes-Benz C-Class and E-Class. But the discount rate of these three models also increased, of which Mercedes-Benz A-Class sales increased 31% YoY, reaching 13,000. And the average price of new cars is about 213,000 yuan. Compared with domestic models of the same segment, the price is the most expensive. But compared with the same period last year, the price dropped by nearly 22,000 yuan, which is related to the increase in sales and the proportion of model sales. The newly-launched GLB retail sales exceeded 5,000 units at around 330,000 yuan. And the average price of the BMW X1 at the same level was around 250,000 yuan. GLB sales and prices have some space for expansion. GLC L retails more than 31,000 units, with discounts and average sales prices remaining stable. The main sales of Mercedes-Benz imported cars GLE retail more than 7,500 units, reaching the level of the same period last year. The average sales price remained at about 790,000, becomes profitable model for dealers.

In March, Mercedes-Benz retail sales were not high in ABB. The first quarter was affected by the epidemic. Various OEMs did not pursue sales. Some orders in March can be transferred to April, leaving room for sales in Q2. Beijing Benz's production rushed ahead of schedule and did not adjust its production plan, which was passed to the sales level. Sales pressure will appear in Q2 as evidenced by the trend of brand discounts in April. If Mercedes-Benz's annual sales target is not adjusted, and the sales progress in the first and second quarters is faster than that of other luxury brands, then the sales pressure in the second half of the year will be less than that of other brands.

BMW

In Q1, BMW brand dealers had a retail volume of 117,000 units, a YoY decline of 29% and a market share of 22.5%. The retail volume of MINI brand dealers was 4,900 units, a YoY decline of 37%. In Q1, BMW (MINI) officially announced sales of 122,000 units, a YoY decline of 29%.

In March, the average transaction price of BMW's new car was 400,000 yuan, up 44,000 yuan compared with the same period last year, and the brand discount was about 14%. The average transaction price of BMW's new cars has increased, mainly related to the new products that have been continuously launched in the past year. After the new 3 series has been facelifted, the discount has rebounded significantly. After new cars go on sale, the price will be greatly improved compared with the original old models, which will help the BMW brand's average transaction price rebound.

During the shutdown of the BMW Brilliance plant, nearly 25,000 units of production were lost. For this, BMW Brilliance adjusted its production plan in March, which helped to ease the sales pressure of domestic produced BMWs. According to data from CPCA, Beijing Benz sales reached 51,000 in March, 10,000 more than BMW Brilliance. In March, retail dealers showed that Mercedes-Benz sold 7,200 fewer units than BMW. This part of the sales difference will appear in Q2. The specific manifestation is that the inventory pressure of Mercedes-Benz dealers will be greater than that inventory pressure on BMW dealers.

In Q1, BMW 5 Series sales reached 27,000, down 14% YoY. In March, BMW 5 Series sales have turned positive, exceeding 10,000, with discounts of around 12%; BMW 5 Series will be restructured in the middle of this year. It was further strengthened. In Q1, BMW X3 sales fell by 16% YoY, and sales exceeded 20,000 units. Sales in March were also close to positive. The discount is the same as that of the BMW 5 Series. The BMW 3 Series was brand new at the end of last year, and monthly sales will remain at around 10,000 units this year. At present, the average price of the BMW 3 Series is more than 300,000, an increase of more than 40,000 compared with the same period last year. And the discount is maintained at around 13%, which is also a great improvement compared with before the change. In Q1, the sales volume and price of BMW's two imported cars X5 and 7 series also maintained a good level.

Audi

In Q1, the sales volume of Audi dealers was 113,000 units, a YoY decline of 25%, and the market share was 21.8%. Audi ’s official sales were consistent with the dealers ’retail sales.

In March, the average transaction price of Audi's new car was 290,000 yuan, down about 20,000 yuan from the same period last year. The brand discount rate was 24%, and the trend was stable. Compared with Mercedes-Benz and BMW, the sales of Audi imported cars are less. The main sales models of Audi Q7 are not yet listed due to the epidemic. Among domestic models, the proportion of small cars such as Q3, A3 and Q2L is higher than that of Mercedes-Benz and BMW which has a certain impact. In terms of the average transaction price of models, the Audi A6L has been listed for 5 quarters, and the average transaction price has remained at around 360,000, which is an increase of 40,000 yuan compared to the price of the previous generation A6L delisting. The average price of the Mercedes-Benz E-class at the same level is 460,000. The average price of the 5 Series is 430,000. Although the sales of the three models are relatively close, they have opened the price range. In the mid-sized SUV segment, the average price of the Audi Q5L is maintained at about 340,000 yuan, and the average price of the Mercedes-Benz GLC L is 440,000. The average selling price of the BMW X3 is RMB 370,000. The three models also have similar sales and different prices.

In Q1, FAW Audi lost nearly 40,000 units of production due to the epidemic, so the sales pressure of dealers was not large. In March, Audi gave priority to providing dealers with A6L, Q5 and other best-selling model resources to help dealers resume sales. In Q1, the sales of Audi's three main sales models Audi A4L, A6L, Q5L exceeded 20,000, and the sales of Q3 and A3 exceeded 10,000. Only imported vehicles, affected by the epidemic and other factors, sales fell significantly, and are expected to be improved in Q2.

Cadillac

In Q1, Cadillac dealers retailed 26,000 units, a decrease of 40% YoY. The market share accounted for 5.1%, a decrease of 1% from the same period last year. In Q1, Cadillac officially announced sales of 26,800 units, a decrease of 40% YoY.

In March, the average transaction price of Cadillac's new car was 300,000 yuan, an increase of 20,000 over the same period last year. Brand discounts increased by 18%, a decrease of 2% compared with the same period last year. Cadillac achieved the average transaction price and double discount rate in one year, which reflects the work performance of the management team. The achievement of this performance is mainly achieved by the release of a more expensive new car and the release of a new car. Compared with last year the ATS-L, XTS, which had an old retail discount of about 30%, was delisted and discontinued. Two new models, CT5 and CT4, were released. The new medium and large SUV model CT6 was launched in July last year. This greatly helps the brand discount rate and the recovery of the average transaction price. However, the discount and average transaction price of the models on sale are not good. For example, compared with the same period last year, the main sales model XT5 has an average transaction price from 342,000 yuan to 306,000 yuan, a decrease of 36,000 yuan. However, the discount rate trend is opposite. In the same period of last year, 25% was reduced to 20%. The rebound of the discount was mainly achieved by adjusting the MSRP. In November 2017, Cadillac released the XT5 28E four-wheel drive model with the MSRP of 379,900 yuan. In June 2019, the XT5 mid-term facelifted, the MSRP of the same model was 349,700 reduced by more than 30,000, which helped the XT5 discount rate rebound. For the two models sold by Cadillac, since the mid-term change has not been made, the MSRPs has not been adjusted, and the discount and average price are more reflective of the true state. The average transaction price of CT6 is 330,000 yuan, which is 43,000 less compared with the same period last year. The discount was reduced by 25%, an increase of 6% compared with the same period last year. The average transaction price of XT4 was 250,000, compared with the same period last year, with an interval of 32,000 yuan. The discount was reduced by 20%, an increase of 9% compared with the same period last year. At this point, Cadillac gradually gave up the sales strategy of high pricing and high discounts, and began to lower the MSRPs, lower the discount of new car sales, reduce the damage of high discounts to the brand, and gradually increase the brand value.

Lexus

In Q1, the dealer retail volume of Lexus was 32,000 units, with a decrease of 18% YoY. The market share accounted for 6.3%. The official sales volume was 28,000 units, with a decrease of 25% YoY.

In March, the average transaction price of new Lexus cars was 410,000 yuan, with a decrease of 50,000 yuan from the same period last year. This is related to the decrease in sales of more expensive models such as Lexus LX and GS.

In Q1, Lexus observed from the retail perspective of dealers that Lexus sales remained unchanged, which was related to Lexus's continuous order sales. Most of the vehicles delivered in Q1 were orders for last year and January, as long as the supply of new car resources can be guaranteed, dealer retail will not have a lot of pressure. In Q1, ES sales reached to nearly 16,000 units, with a decrease of 3.2% YoY. NX sales of 6,200 units with a decrease of 4.1% YoY. And RX sales fell by 35% to 6700 units, but the average transaction price rose by 5,000 yuan.

Jaguar Land Rover

In Q1, the retail sales of Jaguar Land Rover's domestic produced decreased gradually by 46% YoY. The domestic produced Discovery sports facelifted within the epidemic period. Production and batch sales were affected.

In March, Jaguar Land Rover's single-month showroom traffic and orders were significantly improved. 11 policies launched for dealers, including providing epidemic prevention materials for showroom employees, canceling the monthly assessment, giving inventory compensation, and launching comprehensive online marketing training in several areas, effectively alleviating dealer partners ’epidemic prevention and control and business operations pressure. At present, Jaguar Land Rover dealers in China have basically resumed operation.

Volvo

In Q1, Volvo dealers sold 23,000 units, a decrease of 28% YoY. The official sales were 20,000 units with a decrease of 31% YoY. In Q1, Volvo's share decreased by 4.4%. The average price of the Volvo brand is 330,000 yuan.

Porsche

In Q1, Porsche dealers sold 15,000 units, a decrease of 10% YoY. Among them, 6,600 units were sold in March, an annual increase of 51%, and sales started to pick up. In Q1, Porsche took various measures such as quick rebates and financial support to help dealers improve cash flow and increase liquidity. In terms of new car delivery, providing better-selling models to dealers, so that consumers can quickly refer to the ordered car from the dealer, to help dealers resume the new car sales business. In addition, Porsche China maintains communication and consultation with dealers on core indicators that affect dealers ’health operations, such as adjustments to spare parts procurement targets that dealers care about, new car batches, and rebates.

Lincoln

In Q1, Lincoln dealers sold 6,300 units a decrease of 28% YoY. Among them, the sales volume was 2,735,a decrease of 30% YoY. In Q1, the market share decreased by 1.2%, and the average brand price was 400,000 yuan. In Q2, domestic produced Corsair will enter full quarterly sales, which will help increase Lincoln brand sales.

Infiniti

In Q1, Infiniti dealers sold 4,400 units with a decrease of 55% YoY. in March, sales were 1,800, with a decrease of 51% YoY. In Q1, Infiniti's market share was 1.2%, and the average brand price was 300,000 yuan.(Data mismatch )

Maserati

In Q1, Maserati dealers sold 590 units with a decrease of 68% YoY, of which 230 were sold in March, with a decrease of 35% YoY.

Acura

In Q1, the dealers sales volume of Acura was 1,844 with a decrease of 36%YoY, of which, in March, sales were 795, with a decrease of 18% YoY.

Tesla

In March, Tesla retailed 13,000 units, of which 88% were domestically produced model 3. 98% of the sales were in 10 cities. Tesla ’s sales were concentrated in large and mid-sized cities. Shanghai ’s sales exceeded 3,000 units; Beijing, Hangzhou, Guangzhou, and Shenzhen sales averaged over 1,000 units. Beijing sold nearly 1,800 units. Unlimited purchases in the cities of Chengdu and Suzhou exceeded 500 units. Nanjing, Ningbo, Chongqing, Tianjin, Xi'an, Qingdao, Xiamen exceeded 300 units. March is Tesla ’s key quarterly delivery month. Orders are scheduled to acquire domestic produced Model 3 from June 1, 2019, and batch delivery will be concentrated in March. The currently scheduled of Model 3 can be delivered within 2-4 weeks. In April, Tesla launched a financial promotion policy, stating that order acquisition is currently a top priority.

More links:

Rolls-Roycedealers have a retail sales volume of 189 units, with a decrease of 18% YoY.

Bentleydealers have 600 retail sales, with an increase of 4% YoY.

Ferrari dealers have 13 retail sales, with a decrease of 93% YoY.

Lamborghinidealers have 25 retail sales, with a decrease of 90% YoY.

Aston Martindealers have 56 retail sales, with a decrease of 57% YoY.

copyright statement: This article is anoriginal article published by Sang Zhiwei for the first time. For reproduction or adapting, please communicate with the author. In case of any infringement, the infringer will bear the corresponding legal responsibilities. Apr. 29th, 2020, Beijing.

MORE READING

Sales of luxury segment exceeded 3.09 million in 2019, up 7.5% YoY and up 10% expected in 2020.

Luxury car sales are expected to reach 3 million in 2019 and are expected to increase by another 250,000 in 2020.

Sales of luxury car increased by 9.6% YTD with discount rate down by 0.5%

Luxury car market sales in September rose 15% MoM. Sales peak season bloomed as scheduled.

蜀ICP备2021015352号-6

蜀ICP备2021015352号-6